Last week, the whole cryptocurrency industry faced the brutal pressure of avalanche market. In less than 12 hours from the evening of March 12 to the morning of March 13, the total market value of the entire cryptocurrency has evaporated by more than half. The lowest price of bitcoin recorded in the whole network is 3700 US dollars, and that of Ethereum is 97 US dollars. The prices of other currencies are basically cut. These 12 hours of decline basically wiped out the growth of the whole industry in the past year.

In front of the avalanche, everyone is not immune. The secondary market is full of blood. Leverage bulls across the network (bullish bitcoin side) basically burst their positions in total, with the amount of billions of dollars, triggering a large number of closing operations, further reducing the price of digital currency, forming a vicious cycle. Fortunately, under this extremely severe situation, miners have played a mainstay role, stabilized the fundamentals of bitcoin and become the confidence cornerstone of the whole market.

1、 Multiple mining machines touch the bottom line of profit, and the life cycle of 7Nm mining machine is greatly compressed

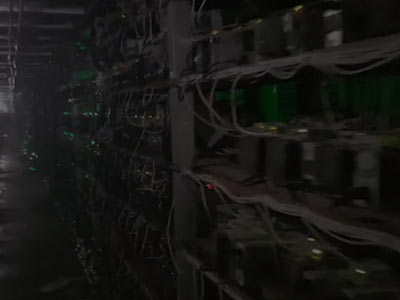

There are extreme market conditions in the market, and the mining industry is also under unbearable pressure. The original plan was to fight another wet season ant S9 and the same generation of other brands of mining machines all retired in advance. According to the theory of cost profit and loss line, two million 14nm mining machines in the whole network should be shut down and removed from the rack, and the calculation force will drop abruptly, and it will remain below 90eh for a long time.

But miners across the network responded immediately after an hour of pause. According to the latest statistics of rhy weekly, the network computing power is currently stable at about 105eh, which means that a large number of miners are suffering losses and continue to dig, ensuring the safety of bitcoin network. At the extreme, the consensus spirit of bitcoin has been tested, and the miners have given convincing answers.

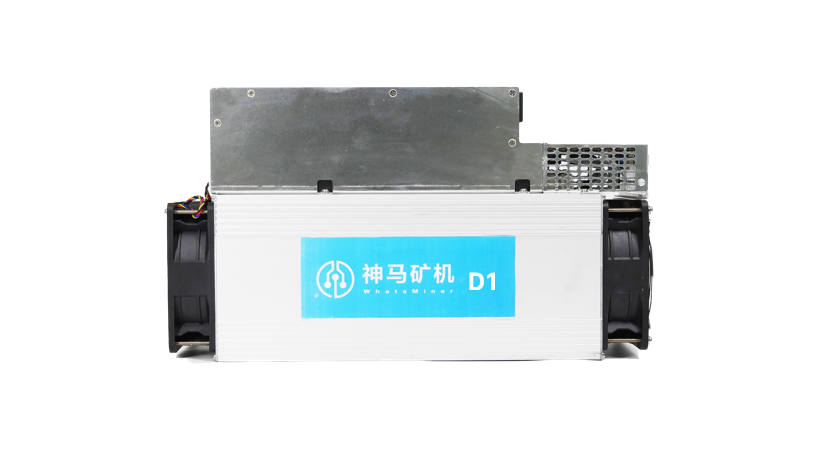

In particular, it is worth noting that the early 7Nm high-power mining machines, such as ant T15, cored T3, Shenma m21s, etc., have approached the shutdown line, accounting for nearly 90% of the electricity cost, and only a small amount of revenue can be generated every day. Most of these mining machines are the new generation of mining machines officially launched last year. The extreme market not only accelerates the elimination of old mining machines, but also shortens the service life of new mining machines. Ant S9 was listed in June 2017, and it will still be profitable this year, with a life cycle of nearly three years, while m21s and others were listed only last year, with a life cycle of less than one year.

The so-called nest covering is not finished. The mining industry is suffering from the huge impact of the market, but the firm consensus of the miners has become the most powerful pillar of bitcoin, stabilizing the confidence of all people.

2、 The era of super mining machine may be advanced, and there is still room for miners to save themselves

Although the current market is stable at about $5000, and the collapse of the first stage has been temporarily stopped, with the further deterioration of the financial situation, no one can guarantee that the market has completely bottomed out, and there are many risks waiting to test the determination and endurance of all practitioners,

Although the secondary market has undergone a tragic wash, it naturally has a high liquidity. No matter what the market is, it will never lack the army of bottom copying. The mining threshold is higher, and the feasibility of a large number of new people entering the market in a short period of time is not great. To cope with the extreme market that may come back, it is more necessary to rely on the miners to actively help themselves and do a good job of "post disaster reconstruction".

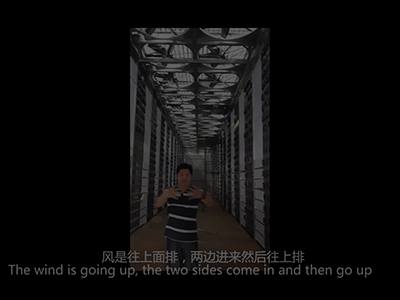

At present, the mining situation is not as optimistic as it seems. The actual situation is that the 14nm miner is dead in name. Although there are many 14nm miners online from the whole network computing power, it is totally unknown how long the miner can maintain the miner at a loss. On the one hand, the mainstream dacaoli mining machine is also in a dilemma. According to the latest statistics of the weekly rhy report, the most common dacaoli mining machine, Shenma M20S (68T), accounts for 75% of the market, with a daily profit of less than 10 yuan. The anti risk ability of the mainstream large-scale mining machines has been greatly weakened, and the miners can only grasp more certainty from the two aspects of energy and machine upgrading.

In terms of energy, it is undoubtedly a great advantage for mining industry to have a wet season approaching. Compared with the annual electricity price, one third of the abundant water power is the most definite advantage that miners can grasp now. It is a top priority for miners to actively prepare for mining in the period of abundant water. Take rhy as an example. This year, the high water price of rhy's own computing base in Sichuan has been determined, only 0.25 yuan / kWh. For the miners who use 0.4 yuan / kWh annual electricity, there is no small temptation. Now they can arrange to log in to rhy.com.

The second is to upgrade the mining machine, from the big calculation machine to the super calculation machine. At present, the market has released the super powerful mining machine Shenma m30s (88T) and ant S19 (95t). The cycle of Moore's law of mining industry is also hard compressed in the extreme market, and the super powerful mining machine which was originally cut in half was pushed to the front stage in advance.

Of course, due to the influence of chip production capacity, production schedule of miner and miner's inventory, ordinary miners may not be able to buy the latest super powerful miner in a short time. At present, some of the large-scale cloud computing power platforms have super computing power mining machine products on the shelves. This week, rhy put on a batch of super powerful computing machines of Shenma m30s (88T). With better power consumption performance and strong computing power, miners can find a shield to resist risks. At present, it is still a small stage of putting on shelves, so miners need to place orders as soon as possible.

A miners' self rescue operation is under way, and the miners will be able to

3、 The ten-year pattern of mining industry may need some changes

At present, the situation is still in the stage that the miners can cope with, but some problems are constantly exposed. In the past ten years of mining industry, some leading forces have been developed in the industry, such as Jianan Yunzhi, a large mining machine factory that has been listed successfully, bitcontinental, the old mining pool f2pool, the owners of major mines, and the leading platforms in the field of cloud computing. At this time, someone should come out to share the difficulties with the miners.

For example, when mining together with mining machine manufacturers, both sides have the best resources in the industry: only the mining machine with production cost and the power without middleman's price difference, this kind of combination seems to be icing on the cake at ordinary times, but in the extreme market, it is a timely help, which can stabilize the computing power of the whole network and maintain the safety of the main network.

The mining pool and cloud computing platform should also actively cooperate to reduce the intermediate cost of cloud computing miners' mining, and try to make the miners able to continue mining. Reducing the cost and threshold of cloud computing mining is conducive to attracting more new forces into the mining circle. Rhy has set an example for the industry in this respect. It issued a notice at the first time: 5% of the management fee has been exempted while the price of electricity has been lowered. New users will save 11% of the intermediate cost compared with the usual one when they enter the mine. The temptation is still very strong.

Every crisis will inevitably promote an industry to make adaptive changes, and mining industry is no exception. The high stability (high locking rate) of cloud computing power stands out in front of this crisis. The whole line of mining machines in rhy mine operates as usual. In the future, cloud computing power should occupy a more important position in the mining industry.

In the face of the industry crisis, the responsibility and belief of the miners have been fully tested. The ten-year history of mining industry is the process of miners building an ideal country with their faith. As long as the faith is not destroyed, the industry will live forever.