Since the start of the Bitcoin market in April last year, sharp fluctuations in the market within a short period of time have frequently occurred in the secondary market. In the early morning of September 25, 2019, the price of Bitcoin plunged 25%, the largest single-day drop in the history of Bitcoin. On October 28, 2019, the price of Bitcoin rose from US $ 8,000 to US $ 10,000 in a short period of time, and more than 15% of sharp fluctuations occurred again. From March 8th to March 9th, the price of bitcoin plunged from US $ 9200 to around US $ 7,600, a decline of more than 15% and breaking the integer mark of US $ 8,000. The market sentiment changed from optimism to panic.

It is not difficult to analyze the trend of the bitcoin market in the past year. Since it hit a small climax of $ 14,000 in June last year, the price of bitcoin has not been able to effectively break through. The skyrocketing slump turned the secondary market into a harvester, and a crop of leeks that had just emerged fell under the sickle.

In the face of extreme market eruption from time to time, all secondary market participants can't help but feel cold. The current problem is not what kind of trading strategy can maximize returns, but how to survive as much as possible in the uncertain market conditions. .

I. Excessive leverage, "stomping" accident staged in the exchange

In recent days, the market has suddenly deteriorated unexpectedly, and the plunge has caused traders in the secondary market to smell a familiar taste. However, the overall pessimism in the market began to emerge early this year. Since the beginning of this year, as an exchange with a relatively stable business model in the industry and a sufficient cash flow, there have been thunderstorms. This is represented by the suspension of operations of the quasi-first-line exchange FCOIN and the black hole of 7,000-12,000 bitcoin funds. We are deeply surprised by the weakness shown by the exchange. There may be a significant deviation between the actual market situation and our perception.

Regardless of the skyrocketing or the skyrocketing, the most injured players will always be the leveraged players in the futures market. In order to ambush the bull market cycle every four years, as early as one or two months ago, there were a large number of long orders in the futures market (betting on the price of bitcoin will rise). The serious imbalance of the long and short positions in the market fully reflects the market. This unilateral bullish sentiment for traders. From last night to now, Bitcoin has dropped by 15%. For the five-fold start (the loss of 20% of the principal has been lost or doubled), it has been capped 100 times (the loss of 1% of the principal has been lost) Or doubled) futures leverage, a 15% drop means that most bullish players have been liquidated or their principals have suffered severe losses. Data show that the total amount of short positions in the leveraged market from the evening of March 8th to the early morning of 9th was more than 200 million US dollars, and the short-to-short position ratio instantly reversed the situation where short orders were greater than long orders for the first time since this year. Analysis believes that this is the result of a large number of long positions and closed out.

The players in the leveraged market are usually senior leeks in the secondary market. Many people have been locked in the bull market in 2017 to the present. They want to rely on halving the market plus high leverage to unlock and even recapture. At present it seems that most people even The last bit of money was also lost.

Unexpectedly, retail investors are hot on the exchange, while mining has a natural immunity to this extreme market. Although the current market is not in a good mood, the mining circle is still full of vigor.

Second, computing power continues to rise, why don't miners fear extreme market conditions?

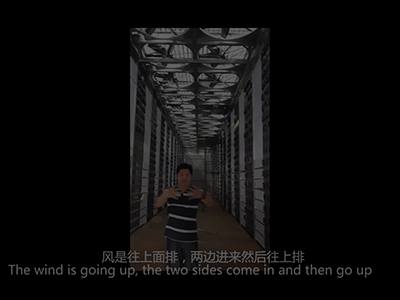

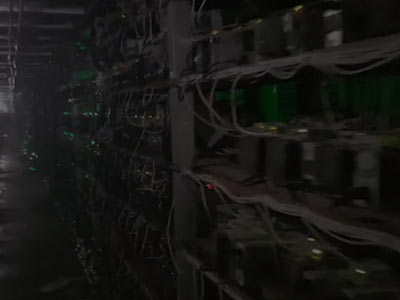

The sluggish market seems to be a big hit for the mining industry that is open 365 days a year. After all, the decline in the market means that the income of the currency standard is shrinking, and it is normal for the mining scale to pull back. However, from the perspective of the Bitcoin's full network hash power, which can best reflect the decline of mining, the recent Bitcoin network's hash power has continued to rise, and is currently stable above 120EH. Yesterday, the difficulty of Bitcoin mining was raised. 6.99% reached 16.57T. As early as half a month ago, Bitmain announced that all mining machine production capacity in the first quarter of this year had been fully booked. All signs indicate that miners have not retreated in the face of extreme market conditions and mining is moving forward.

The market is deeply callback, is the miner "hard and rigid" or really not afraid?

1): Mining cost bottom line is the biggest reliance of miners

In the eyes of people outside the circle, the secondary market conditions have undergone a deep correction, and the profits of miners have been greatly impacted. Most 14nm mining machines may touch the profit and loss line because the market continues to decline. The actual situation is that the cost of mining a bitcoin for a new generation of high-power mining machines is only 20,000-25,000 yuan. At present, the daily net income of each mining machine is between 20-30 yuan, which is still a long way from the profit and loss line. There is still a lot of profitability in mining, and the cost of mining is low enough is the confidence of miners.

2): The so-called shutdown is more a miner's choice of iteration

At present, there are still about 2 million ants S9 series miners online mining on the entire network. This part of the rig has been running for several years and it is time to retire. Even when the ant s9 miner is not down this round, The proportion of the electricity cost of mining revenue has been above 90%, and the daily profit is minimal. The miners just take the opportunity of the market down to iterate the old 14nm miners on the shelf. The so-called shutdown is more the upgrade iteration that the miners actively choose.

3): There is a risk of hedging dividends

5-10 copies per year is the flood season in Southwest China. Abundant, cheap, and green hydropower allows miners to enjoy almost the lowest comprehensive cost of mining power in the world. The mining cost of thermal power is between 0.35-0.4 yuan / degree, and the cost of abundant water is about 0.25. Therefore, the half-season season can save miners one-third of the electricity cost. The saved cost can offset the market. The negative impact brought by the downturn, the pressure of the entire mining industry in the face of the downturn in the market is actually not as severe as the outside world understands.

4): Miner continues to iterate, 5nm chip technology once again reduces mining costs

In the face of extreme market conditions, there are still many cards in the hands of the mining industry, but the technical upgrade is the king of miners' hands. Bitmain has taken the lead in releasing the s19 series miners based on 5nm chip technology, with a maximum computing power of 110TH and a unit power consumption compressed to 29.5j / TH. Compared with the power consumption of a 7nm chip miner, the energy cost of a 5nm chip miner can save another 30%. The 5nm chip mining machine will be listed this year, and then the miner will have another big killer in response.

From the above aspects, the mining industry has made sufficient preparations for the extreme market conditions that may be encountered. Of course, this does not mean that extreme downward market conditions will not affect individual miners. In fact, the market trend of deep callbacks is being eliminated. Miners with computing power, but for the entire mining industry, it is accelerating the iterative growth of the mining industry.

Third, in the face of extreme market, the advantages of mining are undoubtedly highlighted!

The mining circle and the currency circle are actually upstream and downstream in an ecosystem, but we have been used to treating the mining circle and the currency circle as two independent systems. The core reason is that the two have completely different profit thinking, or even opposite. Miners can't get used to the exaggeration of the secondary market, and the secondary market can't ignore the profit of mining. However, the advantages of mining in the face of extreme market conditions are undoubted.

1): Long-term and short-term, different logics determine different ways

Mining is a long-term profit model. Generally, miners look at the market after one year to judge the profit. The speculation of coins is a short-term or ultra-short-term profit model. The violent fluctuations within a few minutes can make a trader go bankrupt. This difference determines that the miners are not particularly concerned about the market price in the short and medium time, and the coins that are dug out when the market price is not good will be settled first. For speculators, once the market trend is wrong, then a real loss will occur. The difference in investment logic determines that miners are more resistant to risk.

2): non-zero-sum game and zero-sum game, different rules, different measures

Mining is a non-zero sum game between miners. There is competition and cooperation between miners. On the one hand, each miner hopes to get more mining rewards. On the other hand, competitors need to constantly join to maintain There is a consensus on the security and strength of the network. The competition between miners is just the difference between you digging a little more and digging a little less, instead of mining alone and leaving everyone with no mine to mine. The environment of traders is different. If one trader in the market earns money, the other trader will inevitably generate an equal amount of loss. This zero-sum game will cause traders to eat each other. One bankruptcy ended.

3): Stacking chips and handing over chips, different processes determine different endings

Miners, regardless of the market, are constantly stacking chips, and more and more coins are in their hands. The secondary market trader is a process of chip loss. As long as you continue to trade, a large number of chips will eventually gather in the hands of a small number of people. Once the market arrives, it is only related to the person holding the chips. Most traders fall on the eve of the market arrival. The closer the market starts, the more intense this phenomenon becomes.

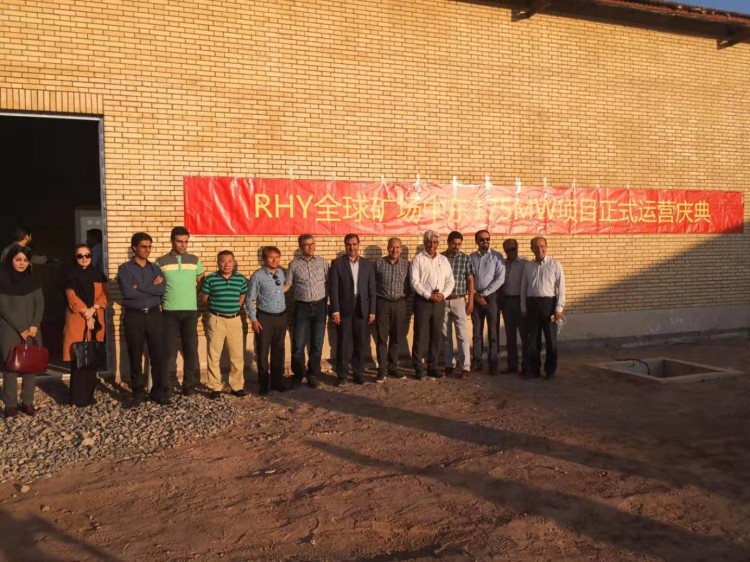

It is precisely because of these essential differences between mining and trading that mining is more robust and focuses on the long-term effects of the market. Therefore, miners can always respond calmly in the face of short-term, volatile market conditions, and miners will win in the future. Will not be affected. At the same time, it also better illustrates when it is not too late to enter the mine. The elderly in the currency circle are scarred and want to switch to the mining circle. It is better to choose the RHY cloud computing power rental platform as the starting point for mining. RHY launches a newcomer experience package, with a computing power as low as 45 yuan per T, buying mining power to earn coins, and paying monthly electricity bills for less money and more revenue. Mining may be the best destination for every currency trader.